Forex Trading for Beginners Guide

Not sure where to begin? Let our guide to forex

What are currency pairs?

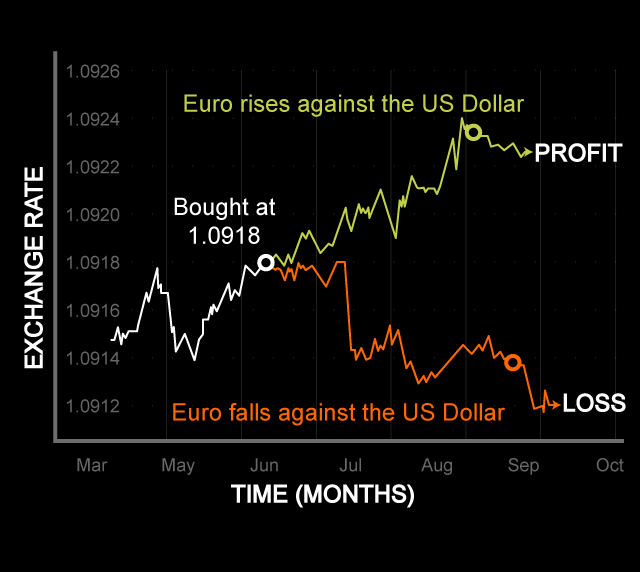

Forex is all about speculating on the fluctuating currencies between two countries. These two currencies are referred to as ‘currency pairs’ and they’re made up of the base currency and the quote currency. The most traded currency pair of all is the Euro against the US Dollar.

How does forex trading work? to buy and sell currencies – with the aim of making a profit. Forex trading will always involve two currencies at a time, the base currency and the quote currency. The difference in price is where you’ll make your profit or loss.

Is forex trading risky?

Any kind of trading has its risks and that’s crucial to always keep in mind, but it can also create profits which is why so many people do it. Again, we can’t encourage you enough to start trading on a demo account if you’re new to forex trading. Once you’re ready for a live account, you should always fully consider the risks involved.

What currency pairs are most popular in forex trading?

While you can trade almost any currency pair in theory, there are certain pairs that are consistently the most traded. These are called Major pairs (it’s in the name) – they make up 80% of the entire trading volume in the forex market.

These major pairs are associated with stable economies and therefore offer low volatility and high liquidity. Example of major pairs include the aforementioned EUR/USD, the USD/JPY (the US Dollar and the Japanese Yen), GBP/USD (British Pound and the US Dollar) and the USD/CHF (the US Dollar and the Swiss Franc). Another characteristics of major currency pairs is that there’s a smaller risk of them getting manipulated and the spreads are usually pretty small.

What are cross currency pairs?

Cross currency pairs are also known as Crosses, and are pairs that do not include the US Dollar – which immediately makes them more volatile and less liquid than Majors. While the US Dollar features in every major pair, Crosses are concerned with more ‘minor’ currencies like the EUR, the GBP and so forth. Popular pairs in the Crosses family include the EUR/GBP, the GBP/JPY and the EUR/JPY.

What are exotic pairs?

Exotic pairs – or just Exotics for short – are those currencies that come from smaller economies and the so-called emerging markets. They’re usually paired up with a major currency. Because these offer the least amount of liquidity and the highest volatility of the three brackets,

Forex charts

A lot of forex trading will use charts to demonstrate movements within the markets. These will usually involve one of three types of chart: the Japanese Candlestick, the Bar and the Line.

The Japanese Candlestick Chart,

or Candlestick Chart for short, conveys a lot of information, making it one of the most popular charts for forex traders. With the simplest components, traders can see the high, low, opening and closing prices on a candlestick chart.

These charts have three points – the open, close and the wicks. The wicks represent the high to low range, and the wide section will explain whether the closing price was higher or lower than the opening price. If it closed higher, the candlestick will be filled. If it closed lower, the candlestick will be empty.

The Bar Chart

shows the opening, closing, high and low of the currency prices. So the top of the bar shows the highest price paid, while the bottom shows the lowest price traded during that particular length of time.

The bar itself is indicative of the currency pair’s trading range, while the horizontal lines show, on the left, the opening prices and, on the right, the closing prices.

The Line Chart

is the simplest of all three graphs, which is why forex beginners love them and advanced traders tend to use Candlesticks or Bars. The line chart simply shows the price movement of a currency pair – by having a line drawn from one closing price to the next – during a specified length of time.

How do I start forex trading?

That’s where we come in. Newcomers to forex trading should always use a broker who is a) regulated and b) has a five-year track record, minimum. With trading, you will need to deposit funds to make the first trade, in what is called a margin account. Needless to say, you can make all the rookie mistakes you want with forex trading on a demo account first, without risking any of your actual money, until you gain more confidence.

Sign up for a demo account today, and take your first steps into the exciting and highly profitable world of forex trading

April 21, 2020

Tags :

Forex

Subscribe by Email

Follow Updates Articles from This Blog via Email

No Comments